First-Quarter Tax Planning

Tax season is fully underway for your 2021 business and personal tax returns! Although this is a busy time, it is also important to simultaneously stay proactive with your current year profit trends and 2022 tax planning. Accordingly, our tax advisors will begin first-quarter tax planning on this coming Monday, February 28.

We are excited to bring you several enhancements to the first-quarter tax planning process. These include a new forecasting model designed to smooth out large fluctuations in income and expenses. We also have a new process to model your expected effective federal and state-specific income tax rates based on current profit levels.

You may have questions about how the Q1 tax planning process works and what to expect, so the details regarding the process and materials you will receive are outlined below:

Scheduling

Each client will be scheduled for Q1 tax planning based on annual income levels. Those doctors most likely to have a Q1 tax deposit requirement will have their Q1 tax planning scheduled first. Newer practices that may not have an estimated tax deposit requirement are less urgent as there is no deadline to meet.

Organizing the schedule based on income allows those clients with likely tax deposit requirements extra time to make the estimated tax payments due by April 18.

With this method of scheduling, you can expect to receive your Q1 tax planning materials between the beginning of March and into early April.

Objectives

It is still early in the year to precisely predict your final 2022 profit figures. However, our team will examine current profit trends to prepare a reasonable income forecast for tax planning purposes.

Keep in mind, the goal during the first quarter is to stay proactive with your current-year tax planning and avoid unnecessary tax surprises later in the year.

Materials

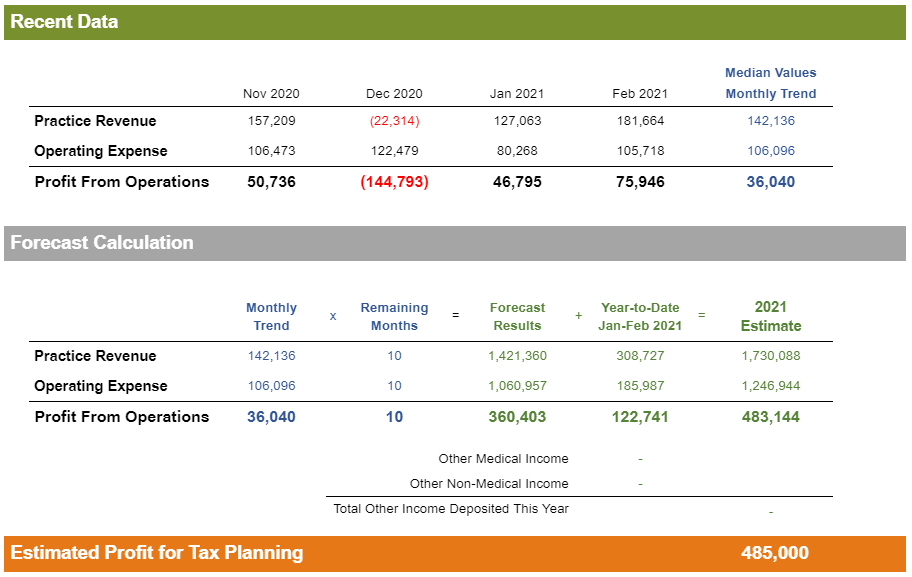

You will receive a Taxable Income Forecast report for each dental practice you own. This forecast will show monthly Revenue and Operating Expense for the trailing four months and calculate current profit trends based on this recent data.

These trends will then be annualized and added to your actual year-to-date 2022 data to arrive at a reasonable estimate of annual profit.

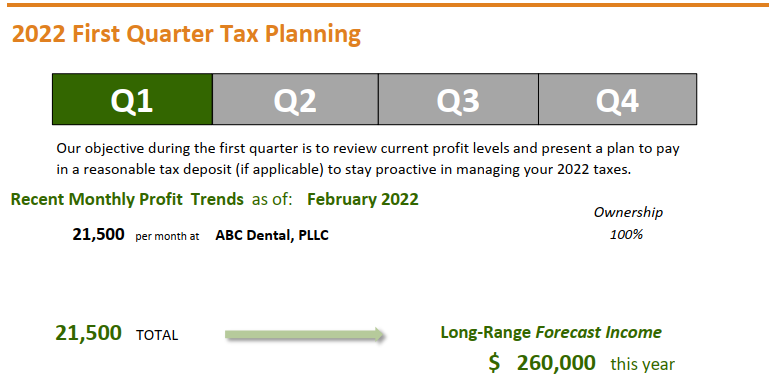

Next, you will receive a Q1 2022 Tax Planning Analysis. This report will show the calculation leading to your Q1 income tax estimate and potential deposit requirement.

If a tax deposit is needed to protect you against under-deposit penalties and interest, our team will provide you with the necessary amounts and payment vouchers. If a tax deposit is not required, this will be shown to you as well.

In either case, you will know where you stand when it comes to your current year tax situation.

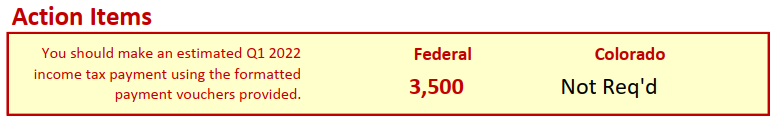

Action Items

If we recommend an estimated tax payment and provide you with payment vouchers & instructions, please make sure and mail in those payments.

When making an estimated tax payment, consider writing the checks from your business checking account as this allows our team to record those payments and count them toward your tax liability during future tax planning.

We realize it can be tempting to believe things may change later in the year, and that a recommended estimated tax payment can be skipped for now.

Tax Saving Strategies

We do not recommend skipping the Q1 payment. If there are equipment purchases or other investments you are considering later in the year, those amounts should be factored in to your second, third, or fourth quarter tax planning when you have fully committed to making those large obligations.

Our tax advisors will provide specific guidance on tax saving strategies you should be planning for this spring and early summer when your Q1 tax planning materials are delivered.

Each subsequent quarter will include additional recommendations to achieve maximum income tax avoidance.

We encourage you to carefully read the guidance provided and execute each strategy recommended every quarter.

Cost

The cost for preparing your Q1 tax planning is straight forward: The base fee is $175 per practice owner. If estimated payment vouchers are required, $50 is added to the base fee and the vouchers will be pre-formatted with specific mailing instructions. If you have multiple dental practices, $70 for each additional clinical entity will be added to the base fee as more time is required for multi-practice forecasts and calculations.

The cost of our quarterly tax planning is intended to be modest while also paying for itself many times over through tax savings. In addition to tax savings, we want to make sure you have peace of mind knowing where you stand when it comes to your 2022 tax liability.